If you are among the more than 17 million American adults who lacks a checking or savings account, you may feel like you are getting by okay with one. Whether you have shied away from opening one due to mistrust in banks or because you feel like such services are too pricey, the reality is that going without one just isn’t practical nowadays — and it can cause you to miss out on a lot.

In a 2016 study, the FDIC revealed that around seven percent of respondents are what is known as “unbanked,” which means that they lack access to a bank account entirely. Another 19.9 percent are “underbanked,” which means that although they have bank accounts, they still rely on services like payday loans, check cashing places, and pawnshops.

If you currently lack a checking account, you’re missing out on some pretty significant advantages. Read on to learn more.

1. Funds Are More Accessible

Although checks are often derided for being slow to write and slow to cash, the truth is that owning a checking account gives you much more reliable and convenient access to your funds. Checking accounts typically include 24/7 ATM access. ATMs that are in your network can be used for free, and you can use ATMs around the country and world for a small fee.

Additionally, most checking accounts also come with check cards, or debit cards, that can be used to make purchases while on the go. As long as the card has a logo from a major credit card, like MasterCard or VISA, it can be used wherever those cards are accepted. Naturally, such cards can just as easily be used online as they can in person, so you can handle your online shopping needs without missing a beat.

2. Checking Accounts Keep Your Money Safe

In the FDIC survey, one of the top reasons cited for not using banks was a lack of trust in such institutions. However, when your money is stored in a checking account, it is insured by the FDIC for up to $250,000. Unless you are planning to keep more money than that, you will be more than protected.

Checking accounts also help to keep your money safe by providing a paper trail for your spending. Rather than pay someone with cash, you can write a check and later refer to your bank statement to confirm the details. You can also easily provide evidence that a check has been paid and cashed in case of disputes. With online access to your checking account, you can even pull up images of canceled checks and view them at your convenience.

Finally, unlike with cash, you aren’t out of luck if you lose your checkbook. Even if it falls into the wrong hands, closing an account to prevent checks from being written is usually easy.

3. Provides You with a Record of Payments and Deposits

For situations where you need clear records, a checking account is incredibly useful. For example, it comes in handy for tax purposes. Plus, when making a charitable donation, writing a check provides an easy reference point that you can refer back to when filing a return.

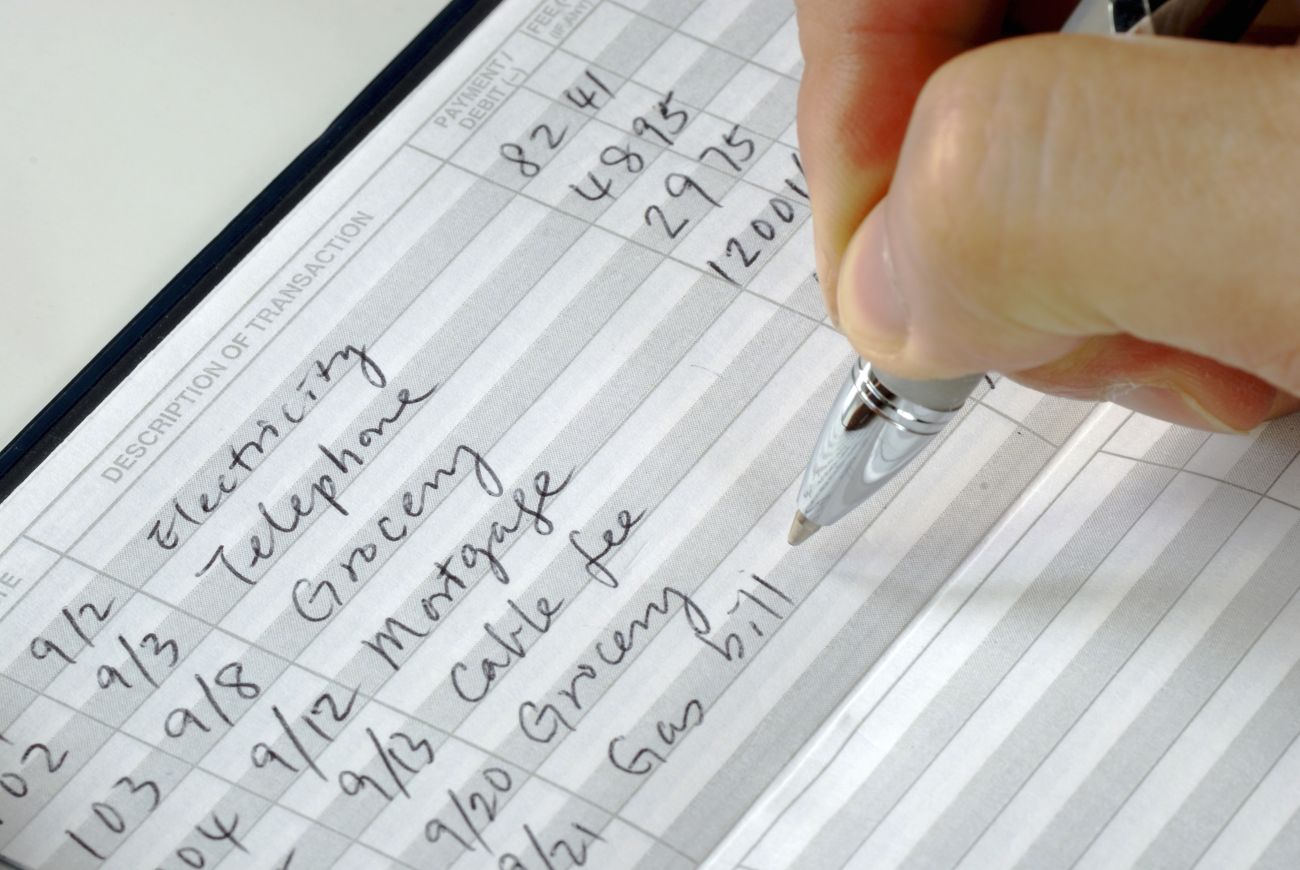

Every transaction that occurs in your checking account is summarized for you monthly in the form of a statement. You can and should also keep your own record in your checkbook register, which you can then balance at the end of the month to ensure that no errors have occurred.

As an added bonus, you can buy checkbooks with duplicate checks. Any time that you write a check, a carbon copy is produced and kept in your checkbook. Even if a check goes missing, then, a record of it will still exist.

4. Gives You Access to Budgeting Tools

One of the best things about modern checking accounts is that many of them come with high-tech budgeting tools that make it easy to stay on track. Simply having access to mobile and online banking is a huge plus because you can keep continual track of your balance even while on the go.

Most banks take things further by allowing customers to set up banking alerts. These alerts are typically delivered via email or text, and they can be set up for several situations. People popularly set up banking alerts for low account balances. So, if your account dips below a certain amount, you will receive an alert and can take steps to prevent additional problems. You can set up alerts for many other things too, including your daily balance, for deposits and withdrawals, and even reminders to pay specific bills.

5. Pay and Get Paid with Ease

These days, most checking accounts include complimentary or low-cost access to bill payment services, so you can manage and pay your bills online or via mobile. With online or mobile bill pay, you can set up automatic payments of recurring bills and even send payments to individual people. In fact, banks are increasingly adding person-to-person payment services to their lineups, allowing customers to quickly send money to friends and family — even if they don’t use the same bank.

A checking account gives you tons of options when it comes to paying and getting paid. You can write a check, withdraw cash from an ATM, and pay with that or pay using a debit or check card that is attached to your checking account. When someone writes a check to you, you won’t have to hunt down a check-cashing place and pay an exorbitant fee for the privilege; check cashing and depositing are usually included for free. While you may have some maintenance fees to contend with, you’re sure to find that having a checking account is a net positive in today’s busy world.