Does your credit score need improvement? Scroll below to learn the basics about credit scores from how to check them to what services can help repair your score.

Although the average U.S. credit score hit 700 in 2017, many people still struggle to build and maintain favorable credit. Habits affecting scores tend to improve with age, but you don’t have to wait to start making positive changes. Getting started now can raise your score and help you avoid mistakes in the future.

What Is Your Credit Score?

Your credit score is based on several factors and represents how well you handle your finances.

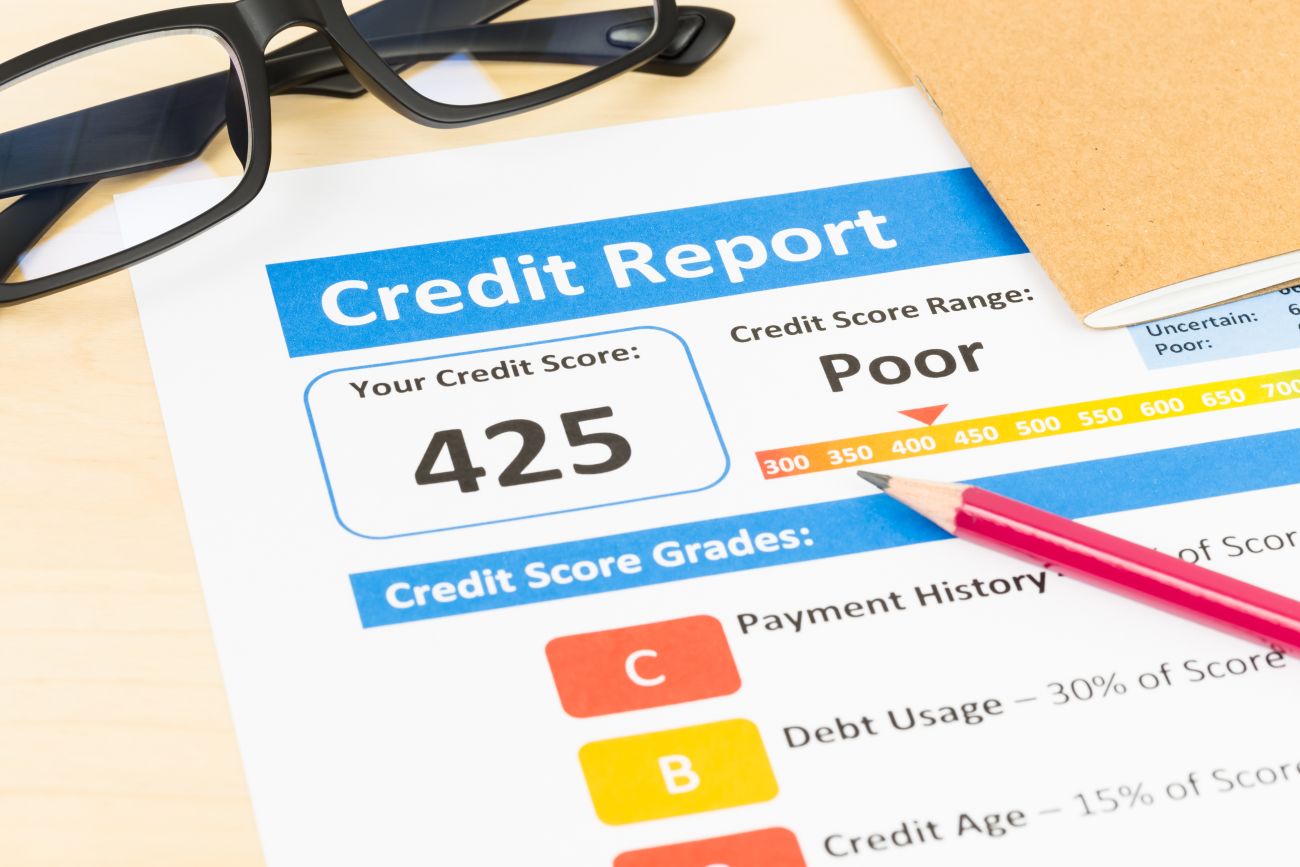

There are several types of scores, but the FICO Score 8 is the number most commonly used by lenders to determine creditworthiness. Five different elements make up this version of the FICO score in varying ratios:

- 35 percent – Payment history on all credit types

- 30 percent – Amount of available credit currently being used, known as credit utilization

- 15 percent – Length of credit history and time since the last transaction

- 10 percent – Mix of credit types available

- 10 percent – Number of new accounts recently opened

FICO scores are expressed in numbers ranging from 300 to 850. To qualify as having good credit, your score must be at least 700. Excellent credit is any score of 750 or more. Maintaining good to excellent credit improves your chances of qualifying for loans and getting favorable rates on a range of financial products, including credit cards and mortgages. Your credit score can also affect your ability to buy a car, rent an apartment, get a job, or purchase insurance.

How Do You Check Your Credit Score?

In the past, lenders used to look at the full credit reports of individual applicants before deciding whether to approve applications. Credit scores have replaced this time-consuming process, which is why it’s important to know exactly where you stand.

Your credit score isn’t included on the free reports you can obtain from major credit reporting agencies like Experian, but there are other places from which you can find out if you need to take steps to improve it:

- MyFico.com provides scores for $19.95 per bureau and includes the FICO Score 8 along with select other versions of the score. Because of differences in reporting, your scores from each bureau may be different.

- Online platforms like Credit.com and Credit Karma provide free scores and helpful financial information in exchange for your permission to receive offers and suggestions from lenders. You may be able to check your credit score as often as once per month to monitor changes.

- Your credit card company or a current lender may provide free credit scores as a service to customers.

What Can Penalize a Credit Score?

Although obtaining a free credit report doesn’t have any impact on your numbers, it’s possible to practice habits with the potential to bring your score down and make poor decisions leading to lasting negative consequences.

One of the most damaging problems is an unfavorable payment history. This is the element FICO weighs most heavily when calculating your score, so it has the biggest impact. Whether you’re in the habit of letting balances roll into the next month on a regular basis or you routinely miss deadlines, being negligent with your payments raises a red flag for lenders. You could get labeled as high risk and be unable to obtain a loan or open a new credit card. Should you wind up filing for bankruptcy, it stays on your credit report and impacts you score for 10 years.

Being a big spender affects the second major factor in your FICO score, the credit utilization ratio. Not only does using more of your available credit make you more likely to carry a balance or miss payments, but it also indicates poor budgeting skills and may make lenders wary of doing business with you.

Even if you’re responsible with spending and are able to make regular payments, you want to avoid opening too many different credit accounts, including retail store cards. Each time you apply for a financial product, the lender or card issuer performs a “hard” credit inquiry to check your eligibility. These inquiries have a negative impact on your credit score and remain on your credit report for two years.

What Can Improve a Credit Score?

Making a few simple changes in the way you spend money and manage your credit can go a long way toward improving your score. These include:

- Establishing a routine to ensure consistent on-time monthly payments

- Paying off existing debt to minimize credit utilization

- Applying for credit cards or loans only when necessary

- Building a credit history if you’re just getting started using credit cards

It takes time to raise your score, but if you’re diligent and patient, you should see a consistent increase over time.

Credit Repair Services

Sometimes you need help to achieve a good or excellent credit score, and a credit repair service can aid you with the process. These services will review your credit report, take steps to fix problems, and provide you with advice on other ways to raise your score. Some good credit repair services include:

- Sky Blue provides affordable basic credit repair, including sending goodwill letters to lenders and offering a personalized analysis of your credit report.

- Lexington Law is a monthly service run by lawyers who can make use of credit laws to improve your score. They also provide credit monitoring, finance monitoring tools, and identity fraud alerts.

- CreditRepair.com takes care of the basics of credit repair and follows up with card issues to ensure changes have been made. Through their mobile app, you can monitor progress by seeing which items have been removed and what’s currently being worked on.

Compare these and other services to find the best match for your current situation.

No matter what age you are, you can take steps to start improving your credit score today. The decisions you make now can affect your score long into the future, so establishing smart spending and borrowing habits lays the foundation for favorable credit throughout your life.